| Q1 2025 West End investments hit £1.71bn, driven by three major transactions despite fewer deals | UK commercial property demand is rebounding, with offices and industrials gaining, while retail lags behind | The Big Six cities, especially Manchester and Leeds, show strong office market recovery and occupier demand |

West End investment rebounds

London’s West End commercial property market saw a robust start to 2025, with Savills reporting £1.71bn in investment volumes across 24 transactions in Q1.

Three large deals dominated, accounting for over £1.1bn. March saw nearly half the total, boosted by Norges Bank Investment Management’s £570m acquisition of a 25% stake in Shaftesbury Capital’s Covent Garden portfolio. Despite transaction numbers still falling short of long-term averages, Q1 turnover was 15% above the ten-year average and 40% above the five-year.

Other significant March deals included GPE’s £56m purchase of One Chapel Place, JD.com’s acquisition of 20 Greycoat Place and a rapid private sale of 17 Albemarle Street for £15.1m. Domestic investors were the most active buyers, while UK sellers led disposals. Savills notes rising demand in areas with improving rents. Prime West End yields fell to 3.75%, suggesting a gradual recovery despite ongoing economic uncertainty, according to Savills.

Signs of recovery in UK commercial property

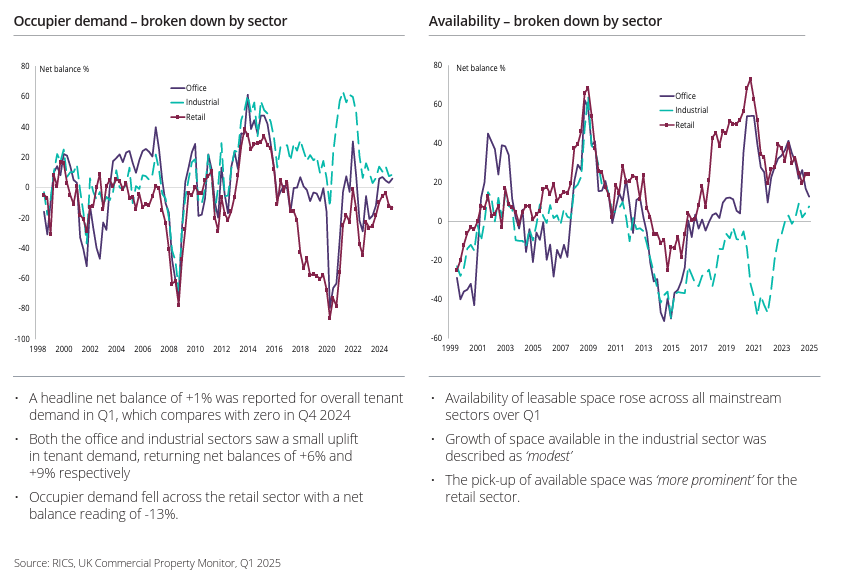

UK commercial property is showing early signs of recovery, according to the latest Royal Institution of Chartered Surveyors’ (RICS) survey, although broader sentiment remains cautious.

Modest gains in office and industrial demand helped push overall occupier demand into marginally positive territory in Q1 2025, although retail continues to underperform. Prime offices and industrial spaces should see rental and capital value growth this year, while weaker outlooks persist for secondary retail and office stock. Data centres, multifamily housing and life sciences assets are expected to outperform.

However, rising National Insurance costs are adding pressure on occupiers and uncertainty from US tariffs has weighed on market confidence. Central London is forecast to lead on prime office rents, while Scotland and Northern Ireland could see the strongest gains in prime industrial. RICS cautions that while sentiment is improving in places, domestic and international policy challenges make the longer-term outlook uncertain.

Big Six regional office markets buoyed by strong demand

Investor confidence in UK regional office markets remains high, with strong demand focused on city centre assets in the Big Six cities.

According to Colliers’ Regional Offices Snapshot, occupier appetite and rental growth are driving activity, with business parks and older stock being targeted for redevelopment. Manchester led the way, accounting for 35% of Big Six take-up over the past year. Transactions totalled nearly 320,000 sq. ft in the first quarter, 14% above the ten-year average. City centre availability has declined for five consecutive quarters, with Grade A vacancy falling to 2.2%.

Leeds started the year strongly, with deal volumes up 53% on Q4 2024. Although Grade A take-up was slightly below average, key lettings at Aire Park supported strong absorption. Encouragingly, demand from financial, tech and media sectors rebounded. Bristol had a slower Q1, with city centre take-up 27% below last year and 40% below the five-year Q1 average.

Occupier demand surges in Scottish commercial property market

Scottish commercial property demand is rising at its fastest pace in three years, according to the latest RICS Commercial Property Monitor.

In Q1 2025, 21% of surveyors reported an increase in demand, up from 10% at the end of 2024. Growth was recorded across offices, industrial sites and retail units. Industrial space led the way, with 37% of respondents reporting stronger occupier demand. Offices and retail space also rose, continuing last year’s trend. Over the next 12 months, 42% of surveyors expect rents to increase across all sectors, with the industrial sector singled out for likely rental growth.

Enquiries for office and industrial space has improved significantly, though retail remained flat. Capital value expectations are up for offices and industrials, but still falling in retail. Longer-term, surveyors remain upbeat despite concerns around build costs, inflation and development constraints voiced by professionals in Glasgow and Edinburgh.

All details are correct at the time of writing (21 May 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.